tax forgiveness pa chart

Engine as all of the big players - But without the insane monthly fees and word limits. Const FP featured_posts_nonce93faf377d9featured_postsdescriptionThe guaranteed rate of return for an I bond is currently 962.

Ny Ranked 5th Least Tax Friendly State In New Study

Dial 711 for assistance.

. As you can see the monthly penalty for. If youre approved for tax forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Earnings Tax refund. In addition to federal income tax collected by the United States most individual US.

The San Diego Union-Tribune Editorial Board has published dozens of candidate QAs and nearly two dozen commentaries connected to a handful of San Diego city ballot measures and seven state. Some local governments also impose an income tax often based on state income tax calculations. People who meet the criteria can receive a refund of up to 05 on City Wage Taxes that their employer withheld from their.

Average for 2022 as of October 6 2022. To qualify tax return must be paid for and filed during this period. Premier advisory firm Brown Schultz Sheridan Fritz BSSF is pleased to announce that Carrie S.

States collect a state income tax. Be informed and get ahead with. The Amish ˈ ɑː m ɪ ʃ.

1999-11 PA 38 of 1999 Which Eliminates the So-Called Excess of Roll 2002-19 Personal Property Additions and Losses. Latest breaking news from New York City. No discounts are available for the Earnings Tax.

1994-14 Changes to Assessment Notice Assessment Rolls Tax Rolls and Tax Bills. May not be combined with other offers. 17th fl philadelphia pa 19102 or waterrateboardphilagov.

Sedgley Ave Philadelphia PA 19132-9801. If you made otherwise eligible payments consolidating means that the. Formal notice of pwd proposed changes in water wastewater and stormwater rates and charges.

The Philadelphia County Assistance Office will consult state records associated with household members ex. Major blackout hits New York City on July 13 1977 On July 13 1977 45 years ago Wednesday a major blackout hit New York City. 2005-07 Millages Authorized by the Voters After April 30 Not Subject to Headlee Millage Rollback.

PA 5 amended the Michigan Income Tax Act to allow a deduction for contributions made in tax years 2022 through 2026 to a first-time home buyer savings account less qualified withdrawals made from the same account up to a total deduction of 5000 on a single return or 10000 for a jointly filed return to the extent not deducted in determining. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. Amendment to section 407 of the real estate tax regulations to clarify the requirements of the longtime owner-occupant program especially for taxpayers with equitable title.

Prepayments include Pennsylvania estimated tax payments carryover credit from the prior years Pennsylvania tax return Pennsylvania tax withheld nonresident tax withheld as shown reported on PA Schedule NRK-1 Tax Forgiveness credit for. The changes announced today meant that the reset doesnt happen. Over 500000 Words Free.

The Amish are known for simple living plain dress Christian pacifism and. Small CPA MST has joined the Firm as a Tax Principal within the BSSF Insurance Practice. If you are completing a paper application mail it to The Philadelphia County Assistance Office 1348 W.

Historically the downside to consolidation was that it reset the forgiveness clock to zero. How will my income be verified. Are you eligible for a discount.

Student Loan Forgiveness Not Subject to Income Tax in Michigan. Latest news from around the globe including the nuclear arms race migration North Korea Brexit and more. Homeowner Tax Deductions Tax Credits.

Eight states impose no state income tax and a ninth New. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. TTY through the Michigan Relay Center.

Amische formally the Old Order Amish are a group of traditionalist Anabaptist Christian church fellowships with Swiss German and Alsatian origins. Finally if you filed your return more than 60 days late the minimum penalty for failure to file is 135 or 100 of the tax you owe whichever is smaller. Your Guide To 2015 US.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Obtain printed materials in alternate formats.

Income-based Earnings Tax refund. Offer period March 1 25 2018 at participating offices only. Content Writer 247 Our private AI.

1994-06 Tax Bill and Tax Roll. Tool requires no monthly subscription. Our experienced journalists want to glorify God in what we do.

Times entertainment news from Hollywood including event coverage celebrity gossip and deals. Chart represents weekly averages for a 30-year fixed-rate mortgage. I supported Trusss desire to cut taxes but preaching the message and carrying it out are very different things.

They are closely related to Mennonite churches another Anabaptist denomination. For the Classes of 2013 and later the Law Schools revised loan forgiveness program VLFP II helps repay the loans of graduates who earn less than 75000 annually in public service positionsParticipants in the program who earn less than 55000 annually receive benefits covering 100 percent of their qualifying law school loans. Truss has proved herself to be a poor imitation of Mrs Thatcher.

Pursuant to section 238 of PA 166 of 2022 the Michigan Department of Treasury posts this notice that it has adopted a hybrid. Forty-two states and many localities in the United States impose an income tax on individuals. Unemployment filings social security records to verify.

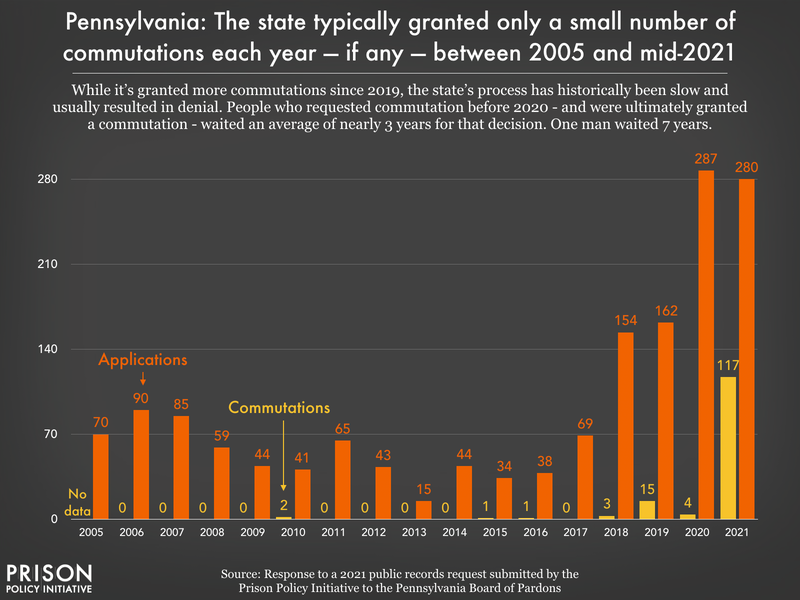

Executive Inaction States And The Federal Government Fail To Use Commutations As A Release Mechanism Prison Policy Initiative

New Federal Opportunity Zone Program Tax Benefits Rkl Llp

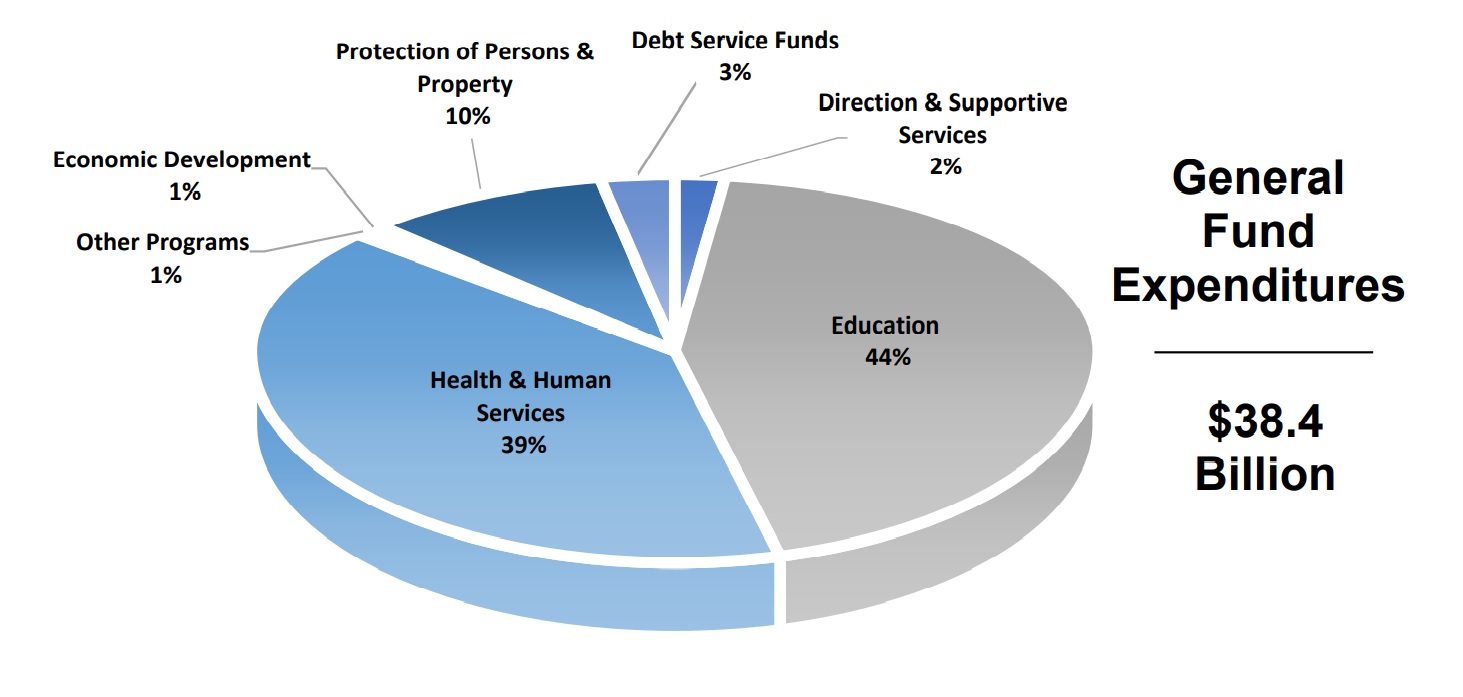

Gov Wolf S Proposed Budget Would Shift Education Spending Tax Burdens One United Lancaster

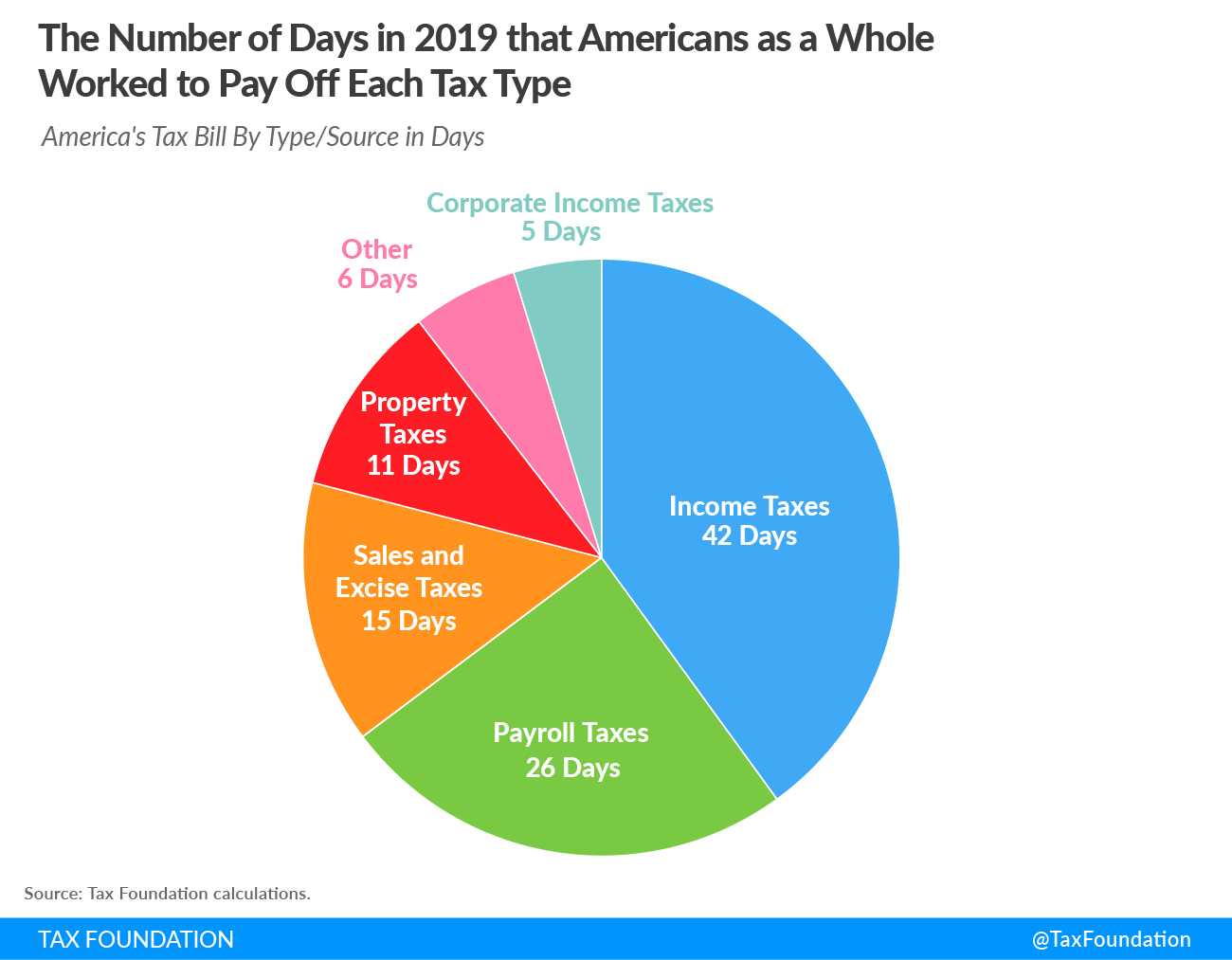

Tax Freedom Day Tax Foundation

Four Winds News Only National Weather Service Employees Organization

4 Charts That Show What Biden S Student Loan Forgiveness Means For America

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

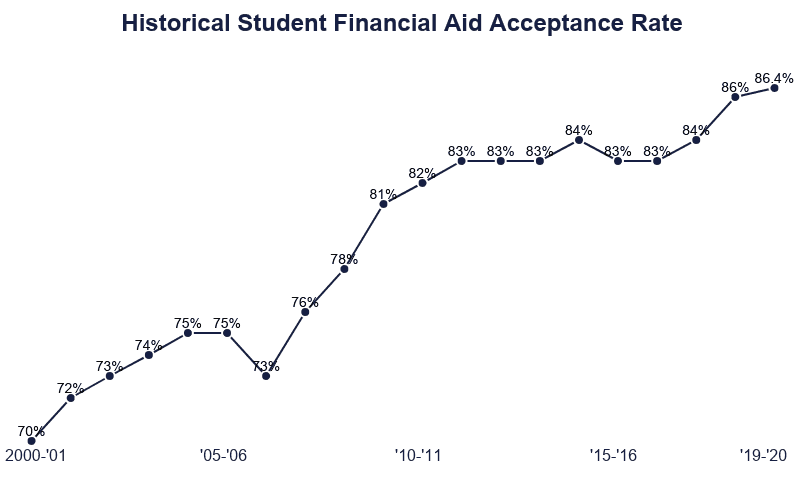

Financial Aid Statistics 2022 Average Aid Per Student

Salt Roadmap State And Local Tax Guide Resources Aicpa

Explore Health Database Edgar Cayce S A R E

Student Loans In The United States Wikipedia

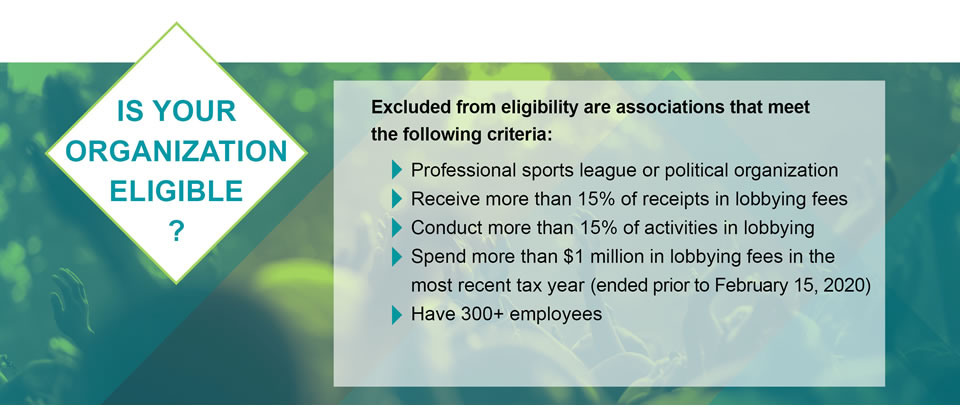

Relief Eligibility For 501 C 6 Organizations Marcum Llp Accountants And Advisors

Make A Pa Earned Income Tax Credit Part Of The Budget